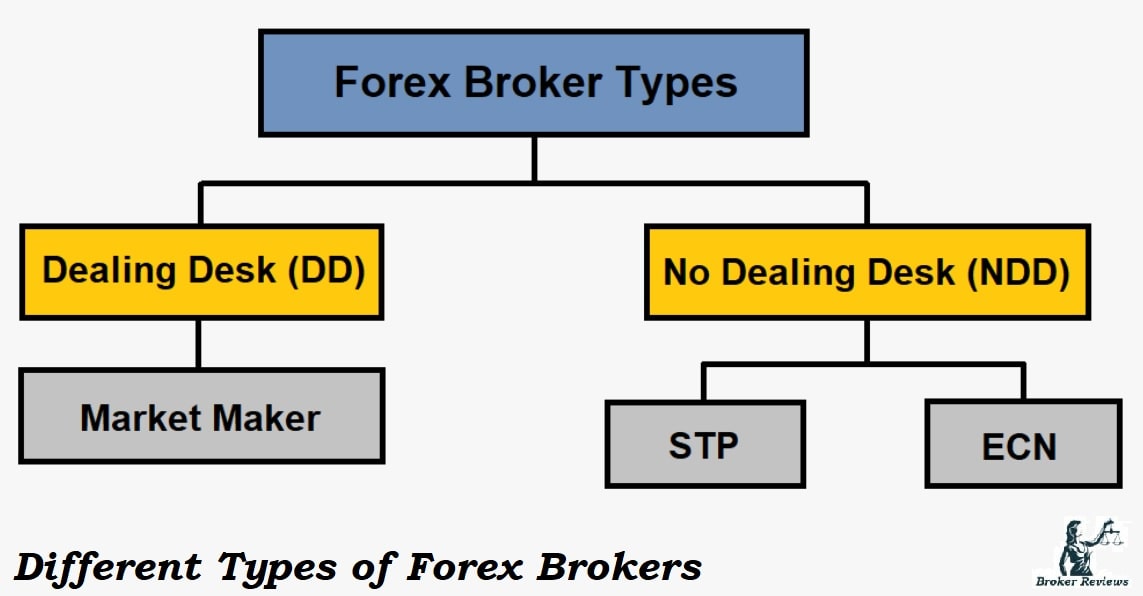

There are different types of Forex brokers and all of them are categorized under two main types: Dealing desk or market maker brokers and non-dealing desk brokers. Traders use each of these brokers based on their requirements and demands; because none of them has superiority over the other. It is completely up to you to choose a broker with small spreads and the obligation for paying commission or select the one with bigger spreads without any needs to pay commission. Daily traders or scalpers usually choose the small spreads and the other one decides based on their conditions.

Further Reading:

Making decisions for using the types of brokers is possible when you know the different types of them with their pros and cons. As all of us know, knowledge is power, therefore, if you want to be powerful traders who make wise decisions in choosing the right brokers for trading currencies. In this regard, there are introductions of the two main types of forex brokers and their pros and cons in order to help you to decide better.

Table of Contents

Types of Forex Brokers : Dealing Desk or Market maker

As the name of the broker is clearly speaking, this type of broker is the one that creates a market for clients. Dealing desk brokers or shortly called the DD broker to bring income for their clients through spreads and providing liquidity. A market broker offers a fixed spread and in the price of providing the lowest cost for your transactions, request an amount of commission.

People who trade in these types of brokers are not allowed to see the real rates of the interbank market through the rates offered by these brokers are very close to interbank rates which are because of the fierce competition between brokers. There is also a great possibility in these types of brokers which guarantee to solve any unexpected problems on their own.

Pros of DD brokers

The DD brokers have a lot of advantages for their clients; but, two main pros of these brokers are:

Fixed Spread- so that, you have the right to see the spreads of the transactions.

Fast Operation- Your trades will be done at the same price you have chosen as fast as possible.

Cons of DD brokers

There are also two main cons in using dealing desk or market maker brokers:

It is highly probable to find out the price is different from the interbank market.

If the trading table is not managed properly, there is a risk of the bankruptcy of the broker.

Types of Forex Brokers : Non-dealing desk

The name of the broker clearly introduces its type; therefore, it is a kind of broker without any dealing desk. Non-dealing desk brokers provide direct access to the interbank market for their clients. It signifies the fact that they cannot enter into a transaction on the opposite side of their customers and only play the role of the medium between two sides of transactions.

Non-dealing desk brokers or shortly NDD brokers are exemplified as bridge builders; because they link two areas of transactions that are impossible to cross; therefore, there are no possibilities to change the price.

In such cases, the offered spread is less but it is not fixed and when the fluctuations increase during a major economic event, the spread can increase significantly. The NPD broker can ask for a commission or increase the spread. There are two types of non-dealing desk brokers:

STP Brokers

Sending the liquidity suppliers to their clients in a direct way is the main feature of STP brokers and these suppliers have access to the interbank market. Most of the STP brokers have floating spreads, but there are some STP brokers that also have fixed spreads. The pros of these types of non-dealing desk brokers areas the same price interbank rates and these brokers require less capital. One of the most important cons of STP brokers is swap and unawareness of the amount of spread at the time of transaction.

ECN Brokers

ECN brokers allow their clients to communicate with other market participants in the Electronic Communication Network (ECN). Banks, small traders, hedge funds, and even other brokers can be these market participants which by presenting the best buying and selling rates, trade with each other. Clients of ECN brokers are able to see the Depth of the Market which shows the amount of the supply and demand at different prices. It is also showing us the number of prices that other market participants buy and sell.

The ECN brokers do not allow us to increase the cost of selling or purchasing; that’s why it takes a low amount of commission. Like many other types of brokers, these types have their own pros and cons. Here are some of the most important pros of ECN brokers:

- It provides noticeable security for traders which does not allow any other traders to have access to your strategies of marketing.

- The ECN brokers do not trade with you.

- Continuity of transactions

- These types of brokers provide liquidity providers to their clients directly.

To mention the cons of the ECN brokers, it is better to refer to:

- High costs which a part of it is because of the commission which is taken in each transaction.

- Uncertainty; there are a lot of fake ECN brokers which makes it difficult to find the best one.

Types of Forex Brokers ; The Bottom Line

There are several traders who are interested in having investments in the realm of currencies; in this regard, it is better to use one of the different types of Forex brokers. They just need to increase their knowledge about various types of brokers and decide which one is better according to their conditions. Generally, there are two types of Forex brokers such as dealing desk and non-dealing desk and the last one is divided into two other brokers; STP Brokers and 2. ECN Brokers. Analyze your situations and conditions and choose the best one to bring a huge amount of profits to your marketing.

References: