Forex Risks management could be defined in a straightforward sentence: avoiding all those risks that make forex trading a place to lose rather than gain profits. That’s why experts believe that if you are tactful in managing forex risks, you will make more money, and if not, you don’t have any choice except to pay off. In the pyramid of forex trading, the second essential skill is risks management which affects your lot size.

Further Reading:

Therefore, if you want to prevent blowing up your trading account, you must consider and calculate all the risks you are under exposure to their radiations. To gain such capability, you’d better go through this article, which thoroughly explains the management of forex risks to control your lot size and consequently increase the number of your profits in a foreign exchange transaction.

In this regard, you are going to be far from those inexperienced forex traders who think that they can easily buy and sell currencies and they are unaware of the tricky capacity of the forex market because forex risk management means using several actions that allow traders to protect their trades from all the downsides of this market.

Table of Contents

The Best Principals of Forex Risks Management

Although the forex market is full of risks and tricks, there are many strategies to manage all of them. However, before learning those techniques, you need to know all the risks that are in the way of your foreign exchange trading. Among all the chances that you may face with each of them, the most repetitive and controversial ones are:

- Exchange rate risk – as the title of the risk is showing, this type of risk is the one which is related to alternation of exchange rate and prices which may put your transactions in danger of loss. Therefore, buying and selling the currencies, especially in international markets, is an average risk.

- Interest rate risk – the sudden increase or decrease of interest rates is another type of forex risk, which affects volatility. The change in interest rate also affects the exchange rate.

- Liquidity risk – The risk of being unable to buy and sell more currencies quickly to prevent losses. Although the forex market is one of the high-liquidity markets, there are some times that you may face its illiquidity.

- Leverage risk – the risk of enormous losses when you are trading on margin. This risk results from the small amount of outlay compared to the capital you have entered into the transactions.

After knowing about different types of risks, it is time to look for strategies to decrease the loss of such risks. Some of the most essential defeating such threats are covered in the following paragraphs to help you be a successful trader.

Increase your Knowledge about Forex Market

Being unfamiliar with the market that you have entered is going to end with doom. In the history of forex trading, all those proud traders who are not updating their knowledge have been erased from this controversial market step by step. Having a piece of vast knowledge of the forex market expands your perspective and unconsciously keeps you conscious of any possible risks.

According to the famous motto of “knowledge is power,” there is no doubt about the fact that more powerful traders are those who know more about the realm that they have decided to conquer. When they know different types of assets in the forex market, they know all the pros and cons of each of them, leading them to manage the kind of risks dealing with different types of currencies.

There are also different types of forex markets that if you want to be a successful manager of forex risks; you should be thoroughly familiar with them which include:

- Spot market – the type of forex market which is the place for the transaction of physical currency pairs.

- Forward market – in this market, there is a contract for future trades upon specific prices.

- Future demand – a contract for future businesses at a set price and date. There is legally binding in a future agreement.

Set Goals for Risks!

Don’t be an unprepared trader who is going to be shocked in facing risks. Influential traders are those who increase their capacity for accepting the risks even before meeting with them. That’s why they are ready to defeat such threats and handle them in a way that not only prevents loss but also increases your profit. So, they always consider any possible risks and set a risk-reward ratio.

In this sense, you should set some goals based on the possible risks and accept that there are always risks in the forex market. But you must be aware of the number of risks that you consider for each transaction. Typically, it is better to only chance between 1 and 3% of your account balance for each of your trades. For instance, if you have a capital of $100,000, the risk amount would be $1,000-$3,000.

Position Size

The portion size is another essential element for forex risks management. Selecting the right portion size is the thing that protects your account and increases the opportunities and the chances of success. To choose the right portion size for your transactions, you must be careful about the following tips:

- Work out on your stop placement

- Determine the risk percentage in your transaction

- Calculating your pip price and lot size

Stop Losses

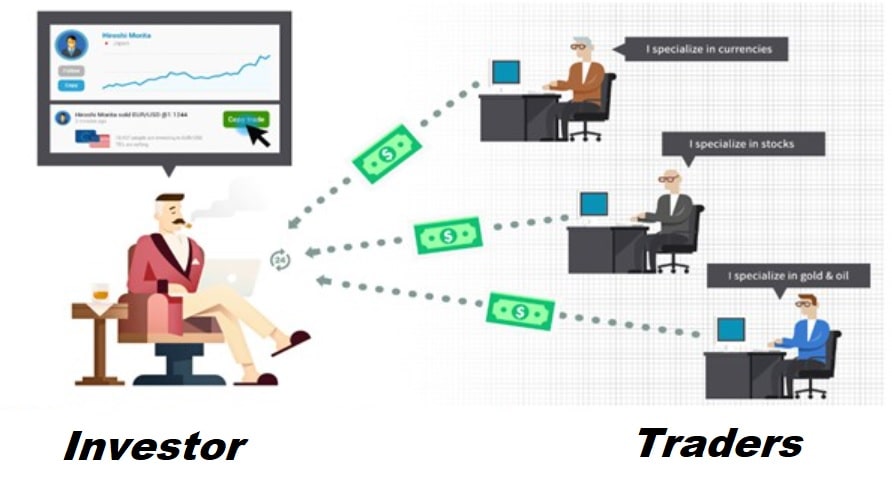

Using a stop loss in forex trading is another essential part of risks management in this trade. It would be best if you looked for stopping losses in the direction of profit targets. In this sense, you need to know how to place the stop losses. In this regard, you can take help from a professional forex broker. This professional broker could help you identify the exact place for exiting your position to prevent more losses. By using the stops, traders can reduce the number of risks effectively.

Leverages

In the forex market, leverage provides the opportunity for the traders to gain more exposure than their trading account; therefore, there is no doubt, they are going to receive more profits. Most of the time, more profits come out of more considerable higher risks. So that, leverage must be managed more carefully.

The studies about leverages show that traders who bring large balances and take more minor influences gain more profits than those with lower ratios and higher forces. Because those who are into fewer leverages are less in danger of risks, and they focus more on their mindsets and strategies in their transactions rather than dealing with threats.

Controlling Emotions

Human beings stick to their emotions, and unlike all those financial self-help books that claim that being a successful forex trading needs putting your emotion aside, they cannot remove their feelings. However, for managing the risks in your transactions, you need to handle your emotions; otherwise, you will get carried away by impulsive emotions, which could disable you from managing different forex risks.

Pay attention to News and Events

The dynamic feature of the forex market is the element that affects different aspects of forex trading. We live in a world filled with other social, political, and economic events that could affect the forex markets. That’s why the experts believe that most of the forex risks could be managed by monitoring the recent news and events about the forex market and any related events which affect this popular business.

Use a Demo Account

Nothing like experiences could help you manage your trade and all the risks surrounding your forex trading goals. That’s why most traders who have more experience can be successful in forex risks management. However, if you are a beginner in the forex market, there is no need to worry about forex risks management. Hopefully, most forex brokers have provided demo accounts where you can practice trading and measure risks without facing any real danger.

Further Points for Managing Forex Risks

Apart from the ways above, there are other ways to manage forex risks that could help you act better in your trades. For instance, a plan essential for addressing the whole life shouldn’t be forgotten in forex trading. A successful trader always has plans A and B for their transactions, including all the trading strategies for making profits or reducing the risks.

Try to be one of those traders who have a plan for future trading and keep records of past transactions. By analyzing previous transactions, you can understand the risks better and not forget them. Another way to become aware of the possible risks and be ready to manage them is through forex charts analysis. Most of the time, you can hit your goal in forex risks management with the help of such research.

The Bottom Line About Forex Risks management

By having the best forex risks management, you can control the number of losses and profits better. After recognizing different types of forex risks, it is time to use the tools and strategies defined for handling risks. For instance, the basic process for defeating risks is extensive knowledge about forex trading and accepting its risks. Then you can manage the portion size, the leverages, and your emotion. By using a demo account, you can increase your knowledge and practice risks management.

References:

https://www.investopedia.com/articles/forex/10/forex-risk-management.asp