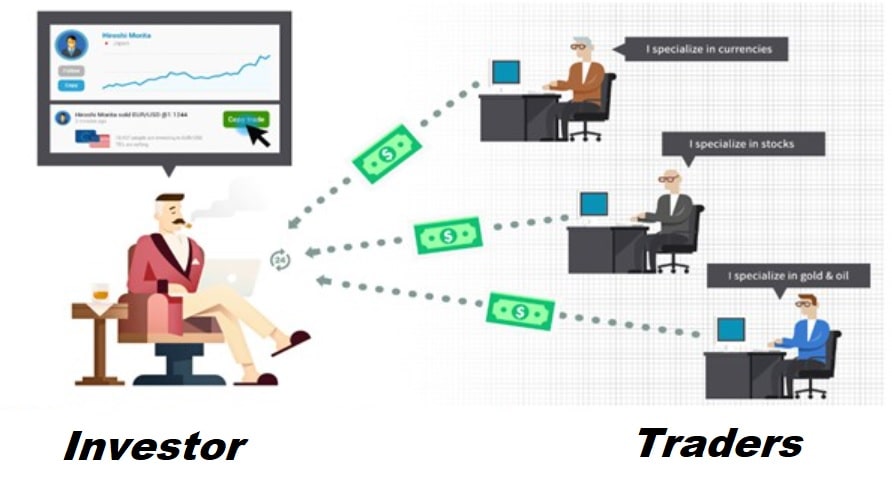

The main role of a Forex Broker is to act as a means for trading stuff like currencies. Traders who are seeking success in the currency market, require a medium between them and the market like Forex Broker; in other words, they need a place to find a buyer or seller and this broker is the exact opportunity for finding them and consequently, make a huge amount of money. However, it could be more than medium and if you know the techniques of using Forex Broker, you will be able to make a huge amount of money.

Further Reading:

Regarding this point we could get to the definition of a Forex Broker which is a company that provides services for gaining a huge fortune from foreign exchange market. After researching and choosing the right broker, to start Forex trading you need to follow some steps. At first, connect to the internet, then learn how to use the platform of the broker that you have chosen, then open your account and begin your trading which could bring you a huge amount of money.

The information to help you in making money by Forex broker is covered in this article and the related elements to this important matter is also given in order to help you to make more money.

Table of Contents

Position size and pip in Forex Trading

For making money by Forex broker, you must be familiar with two trams of Forex trading: Position size and pip. A pip, which is an acronym for “percentage in point” or “price interest point,” is a useful tool for measuring the smallest price movement made by any exchange rate. A pip is equal to the fourth decimal place in the price of a currency pair. Pip is one of the Important tools of each Forex broker; because, its movements is the thing that signifies the loss or profits of each trade.

The position size is a determination for the number of lots and the size and type of lot you buy or sell in a trade which is closely related to the value of pip. These two are the basic terms that you must know for making money by a Forex broker. Search more about them and look for them. You can get the importance of these two factors in the following paragraph.

Making Money by Forex Broker

Certainly, when you choose Forex trading for marketing and gaining money, you have researched everything related to working with forex platforms. You know that by buying or selling a currency pair, you can earn profit or lose your money for several reasons such as pipe moves, the size of the position and the value of the pips.

Most Forex traders use the price charts for managing their transactions and based on that decide to buy currencies; for instance, if the chart’s expectation signifies the fact that there is a possibility of raising the price of EUR/USD, they will buy these currencies. A smart forex trader, analyze the chart and look for the expectations and decide based on them. Thus, Forex like the price charts.

A forex broker lets you know the amount of spread in each transaction. The cost of transactions or the difference between the buying and selling price is called Spread. Spread is calculated based on the current price of selling or purchasing the currencies. As the result, those traders who are using Forex brokers, become aware of the current price of currencies very soon and based on them do such transactions which have the capacity to bring them a huge fortune.

Minimum Capital Required to Start Trading Forex

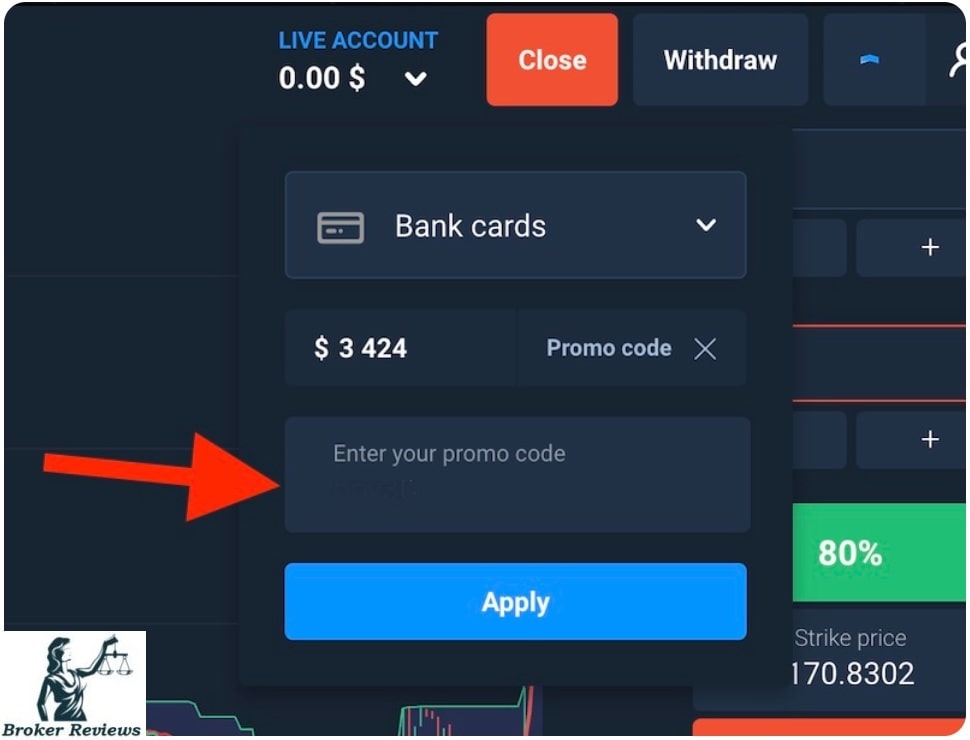

After gaining the required information for starting trading Forex, it is time to provide the minimum capital for it. For making money by Forex broker, with minimum risk of loss, the Forex traders should not risk more than 2% per trade. Traders, who are dealing with daily transactions, must risk 1% or less. Here, risk is measured as the distance between the entry point and the stop loss level (where a failed trade closes) in pips. This amount of risk is going to be multipulated by the value of the pip and the size of the position. Note that this risk must be less than 1% of the total account balance.

Time Frames of Forex Trading

Since forex trading is a global market which many are using at different times of the day, it is open 24 hours a day, 7 days a week. Sunday evening is the time for opening the Forex trading (in the US) and immediately after that, European markets and then the North / South American markets are going to be open. This process continues throughout the week until the US market and all the markets which are in the time zone, closes on Friday.

In this regard, all the investors have the chance to have transactions from Sunday to Friday. often use GMT time because of the difference of the time in various regimes of the world. The main markets in the realm of trading Forex are in the cities of Sydney, Tokyo, London and New York. Sydney opens at 21:00 GMT, Tokyo at 23:00 GMT, London at 7:00 GMT and New York at 12:00 GMT.

Following the time frames is a way for making money by Forex Brokers. Pay attention to the time frames as well as the other options and note the time changes because of the alternations of seasons.

Make Money by Forex ; The Bottom Line

A big-time trader is completely aware of the roles of a Forex broker in their success for their transactions. The profits that they are able to achieve by Forex broker is so much that they never lose the chance of using a broker. Making money by Forex broker just needs to know some basic terms like pip and position size and provide the amount of inflation which is accompanied by less risk of loss. It is also important to know the best time for doing transactions in the broker trading and markets.

References: