Copy trading is one of the popular kinds of trading which has its specific features. By looking at the history of trading, you will understand that this type of trading was born in 2005 out of the mirror trading. You can guess what this type of trading by its title is. However, if you want to be a successful trader with immense knowledge about different trading branches to use them for their success, you’d better go through this article.

In this paper, you will read the exact definition of trading, its pros and cons, and essential information that you might want to know. It would be great for those who want to be successful forex traders to know about this type of trading. Because by copy type of trading, you are allowed to trade in any field you desire.

Best Copy Trading Forex Brokers:

Table of Contents

Copy Trading Definition

As a copy trader, you try to follow the strategies that a successful trader has went and achieved huge profit. The only point in such trading is that you must follow a trader with the same opinion and trading style you believe in; otherwise, you will lose your capital without any profits. For instance, if you are into conservative trading, you should find a successful conservative trader to follow. So, the type of trading style must match your goals and beliefs about trading.

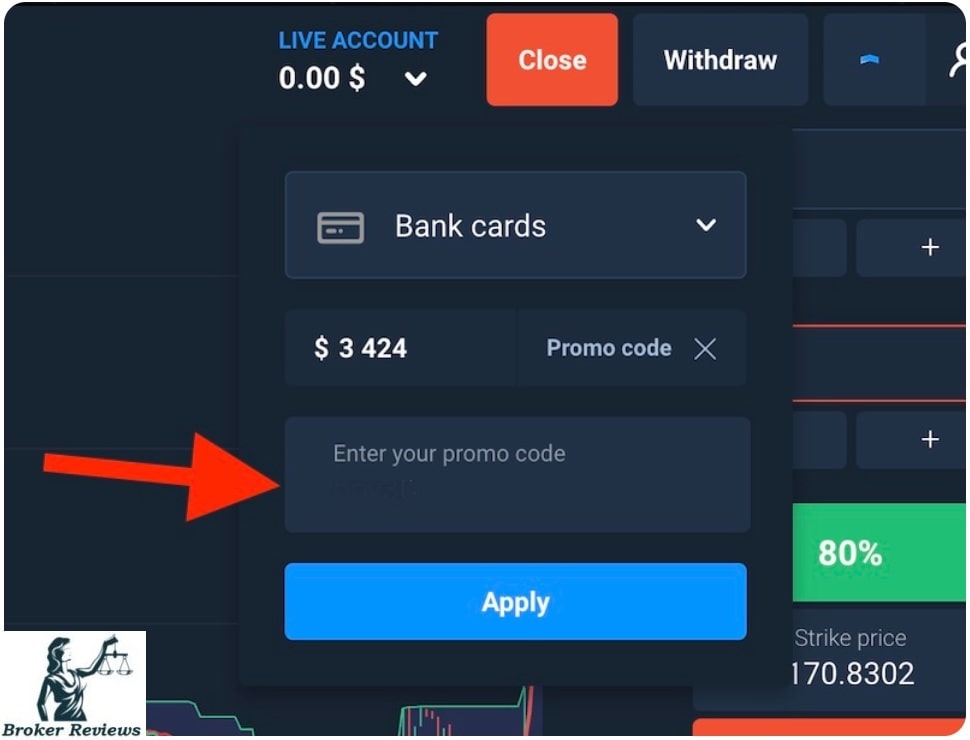

Another thing that you’d better know about copy trading is the fact that you can do it on your own or a trading platform. Like many other trades, there are a lot of platforms for copy trading. The copy trading platforms work simply. At first, you should choose a trading activity that you want to mimic, then the platform will follow it automatically. Therefore, copy trading can be done manually or automatically.

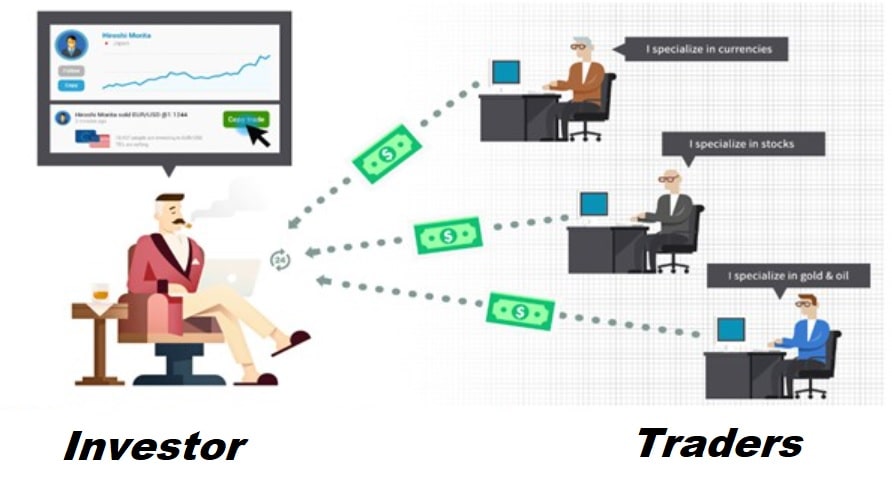

When it comes to copy trading, we will discuss two types of traders who are active in transactions—the one who makes the trading decisions and the trader who copies the first person’s trades. Experts have chosen titles for these two types of traders. The first trader is called the master, and the second one is known as the follower. Therefore, the one who plays a crucial role in transactions is the master. That’s why it is suggested to be careful in choosing the master trader; otherwise, there will be a massive loss for the follower.

How Does the Copy Type of Trading Work?

This type of trading comes with a kind of social network. By social networks in trading systems, we mean a social relation in the trading platforms that allows the other traders to become aware of the other trader’s activity. For instance, if a trader opens a position on the trading platform, you, as a copy trader, will understand and decide about opening the same position, or the automated trading platform that you have chosen will do that for you without additional input from you.

Sometimes, this type of trading is because of the matter of experience. It would be ideal for all the inexperienced traders to rely on experienced traders who have worked in the market more than the others; because they know much more about trading and all the ups and downs in the market. So, those beginners who are new in the market can follow professional traders to make up for the lack of experience.

Among all types of trading, forex copy trading is the most popular one because of the slight price movement in forex trading. Because of the minor price movement, the lesser risks you will face in your copy type of trading. Here, the platform that you can use for forex copy trading is the MT4 platform which is one of the famous platforms in forex trading.

Pros and Cons of Copy Trading

Like many other tradings, this type of trading also has its advantages and disadvantages. Knowing both the weak points and power points of this trading help you to decide whether it is suitable trading for you or not. In this sense, go through the pros and cons, which is the result of many studies on the copy type of trading.

Pros of Copy Trading

The advantages of this type of trading are extraordinary, especially for the new traders in the trading markets. To mention the most significant pros of this type of trading, it is better to consider:

- Lower risks for beginners – In copy trading, you don’t have to spend so much time analyzing the markets; therefore, the first advantage of this type of trading is that you can simply have access to a professional trader’s investment knowledge and experiences. For sure, this is going to increase your chance of having more successful trading. More than that, this type of trading is going to reduce the trading risks for beginners. Most of the newbies in trading have lost so much money because of a misunderstanding of technical and fundamental analysis for managing such risks.

- Transparency analysis – Another advantage of copy type of trading is the transparence of the previous trades and analyzing of copy trading account. In other words, the copied trader can get to all the previous trading records to analyze the future of the trade that they want to do. So, when you enter a professional trader’s account, you can see their actions’ graphs and analysis. You also have access to all the monitory account. That’s why it is said that this type of trading is one of the best for beginners.

- Learning to trade easier – The other benefit of this kind of trading is a low risk while learning tips. As you know, trading like forex trading is full of tricks and complexity; therefore, trading is not an easy task at all. On the other hand, it seems that planning for trades and performing them need so much time, and all people don’t have that much time to spend on such a long process. So, by using this platform, beginners can enjoy vast profits from different markets and reduce the time and energy they must spend in regular trading. Plus, they can use the training aspects of copy trading platforms and learn proficiency in trading.

- More Security – the Security of copy trading accounts guarantees access to just the account owner. It means that no one except the owner of the account has access to the trading account.

The pros of copy type of trading for professional traders

One of the noticeable advantages of this type of trading for professional traders who are idle for copy traders is earning a commission. As a professional trader, you can signify the number of investments you want to be involved in copy trading. So, copy management for professional traders helps them be more relaxed in their investment and those who copy their trading deeds.

Cons of Copy Trading

Although this trading has brilliant advantages, like many other things globally, it has its downfall. In this regard, one of the main cons of such trading is the possibility of making horrible mistakes by the trader that you have chosen to copy. In some cases, it could lead to the destruction of your inflation. Therefore, the wrong decision could decline your trading account to zero. Another disadvantage of copy trading is when the professional trader decides to make big trades with vast amounts of capital and high risks; in such situations, it would be difficult for the copied trader to follow the steps and accept the risks.

All in all, you should consider the fact that your success is bound to the movement of another trader. So, it would be best to look for the most reliable trader that makes you sure about the low percentage of the risks. Otherwise, you are going to lose your chance of having successful trading. And finally, the last cons of this type of trading that comes to mind is the lack of knowledge about the strategies that will be used in the future and how the transactions are going to be done.

How to Choose the Best Trading System for Forex Copy Trading?

In the trading world, there are hundreds and even thousands of platforms that may make you overwhelmed in choosing one of them. That’s why many traders are worried about finding the best trading system for copy type forex trading. However, there is no need to be anxious if you take some simple steps and consider some simple points.

For finding the best trading system for copy trading, you shouldn’t bound yourself to the reputation of the trading system. In this sense, you should look for a system that matches your trading goals and your trading conditions. As mentioned earlier, if you are a conservative trader, you should look for a conservative trading system or find an investor with a lower average loss per trade. Or, if you are an aggressive trader, find a trading system with high volatility which means, there would be higher risks for losses.

The other way to find a professional trading system or trader to follow is to ask from the other highly qualified traders that you know and trust. An acquaintance who is familiar with your trading style and the desires that you have. Because all the professional traders know each other’s style and background; therefore, it would be easy to find the one with a closed attitude to your trading style. After all, by a simple search on the internet, you can find lists of the best trading systems and the most successful traders to follow. You only need to study their background and success and the reviews of the other copy traders.

All in all, you’d better consider some essential factors when you are choosing a trading system. These factors are:

- Number and proficiency of traders to copy.

- Security and regulation.

- Finding winning traders.

- Understanding and analyzing their strategies.

The Best Copy Trading Brokers in 2021

According to many records and studies, there are a lot of brokers for copy trading. Some of these brokers have gained a reputation and are known as the best broker. In this regard, there are introductions of the 7 best copy trading brokers here to help you find the one that helps you achieve what you want.

1. eToro; a winner broker

eToro is one of the best brokers for copy form of trading that is also known for being a winner. This broker has achieved this victorious title for the quality of an easy-to-use copy-trading platform that makes traders successful in their transactions. You can use this broker for different types of trading, such as CFDs, forex, and cryptocurrencies. In 2007, eToro started its work and achieved a regulation that makes it a safe broker for forex trading and CFDs.

Compared to the other broker, eToro is a little expensive for forex trading and CFDs transactions. However, this broker offers zero-dollar commissions for US stock trading. The main factor that makes eToro a winning broker is the services that it has provided for the copied trader. Therefore, it would be good to study more about this broker if you want to be successful in copy trading.

2. AvaTrade – the Runner-Up Broker

AvaTrade is another popular broker that has become a global trusted trading system by offering different platforms options. The reputation of this broker is based on several factors, in addition to being one of the best platforms for copy trading, which include providing a chance for mobile trading and have the capacity to train its users. Like the eToro, it is regulated by reliable jurisdictions, making it a low-risk broker for forex and CFDs trading.

If you compare AvaTrade with similar brokers, you will find that it is not the best broker for low-cost trading. However, if you are a professional trader in the EU, you can enjoy the low commission. This broker could do social copy trading with the chance of earning huge benefits; because it is one of the most competitive platforms in providing a chance for copy trades.

3. PrimeXBT – A Broker with Extensive Trading Options

PrimeXBT is one of the well-known trading platforms which is famous for three essential features, including:

- Providing access to an extensive range of markets and a wide range of trading instruments.

- Reducing the trading risks.

- Helping you to trade as quickly as a professional trader.

This broker was founded in 2018 and has got the Australian ASIC regulation. You can use this broker for trading forex, commodities, indices, and cryptocurrencies. Customer support in the form of live chat and Email is another factor that makes this broker reputed. By PrimeXBT, you can set stop loss and take profit order. The high volume and leverage in this broker are other advantages of the broker. The only downfall with this broker would be the limitation of paying deposits only via BTC, ETH, USDC or USDT.

4. Naga – Auto-Copy Trading Broker

The other famous copy trading broker is Naga which automatically copies your trade. Most traders who have worked with this broker are satisfied with services that allow them to identify the traders with the highest profits to follow. Naga was founded in 2015, and CySEC and FCA regulate it. You can access a demo account in this broker, and you can safely trade CFDs, forex, shares, indices, cryptocurrencies, and commodities. The significant features that make this broker noticeable are:

- Providing automated copy trades tools.

- Messenger for sharing analysis.

- Having access to all trading markets of Naga.

- Letting you set stop loss and take profits.

- Offering easy to use investors leaderboard.

Further advantages of Naga, which attracted a lot of attention to this broker, include:

- Excellent customer services such as phone support, live chat, and email support.

- Providing educational resources.

- Support trading on platforms like iOS and Android.

Some traders who have used this broker for trading have claimed that there are only two disadvantages with Naga. The first one is the withdrawal fees, and the second problem is overnight charges.

5. FXTM – An International ECN Broker

Another popular copy trading platform is FXTM which is very active, especially in Asian and African markets. By choosing this broker, you will have the chance to select your account type among many choices. FXTM was founded in 2011 for trading metals, commodities, stocks indices, forex, and crypto. This broker is regulated by FSCM and provides excellent customer supports, including live chat, Email, and phone calls. Moreover, you can begin trading with a minimum deposit of $10 by this broker.

There are a lot of characteristics that make FXTM different from the other brokers, such as:

- Letting you have access to all your trading accounts from one place.

- Providing more than 250 financial CFD tools.

- Allowing you to have commission-free trading.

- Offering you an extensive range of research and education.

- Letting you open an account quickly by using digital features.

- Fast deposit and withdrawal.

- Multiple regulations such as FCA, CySEC, FSC

If you are looking for the disadvantages of this broker, it is better to mention two significant cons which could play an essential role in your trading. The first con of FXTM that you should know is not offering its trading platform, and the subsequent downfall is a limited product portfolio.

6. ZuluTrade – A Broker for Copying other Investor’s Portfolios

ZuluTrade was founded in 2007 and got regulation from CFTC and NFA. It is one of the best brokers for copy trading, which helps you choose the trading system based on minimum deposit. You can log in to ZuluTrade via Facebook, and there is an allowance to use a demo account. This broker provides you with a chance to download a spreadsheet of all the simulated trades. In this sense, you can analyze the trades better. So, you can copy the other investors’ portfolios. Another good news about this broker is that you can join it for free, and you just have to pay the spread on trades.

To mention to the ZuluTrade’s pros, we could list:

- A great platform to copy Lots of traders;

- Professional risk management for both experienced and inexperienced investors;

- Providing customer supports such as live chat, Email, and phone calls.

The result of a study on disadvantages of the ZuluTrade shows us the fact that:

- There is no integrated broker.

- There are some difficulties such as selling phone numbers and Email to brokers, errors in copy trading, and poor reward management.

7. MetaTrader 5 – A Powerful Platform for Forex Market

This powerful platform was established in 2000 and has gotten NA regulation. Therefore, it is a securities broker for trading forex, stocks, and Crypts. This is the best copy trade service provider with MQL5 language, allowing you to access automated trading software. With this copy trading platform, you can open 100 currency or stock charts at a time which could bring you a massive fortune. This broker offers you different versions of the platform, including desktop, web, and mobile.

Using Meta Trader 5 allows you to access the advance chart and graphics to analyze the trades and traders. This fast, easy-to-use, and flexible platform offers you several analytical tools. Furthermore, there is no need to worry about saving data and manipulating trade; because you can set it quickly. Many investors have claimed that they enjoy the visual display and the great colour and time frame of this platform.

The only weak points of the Meta Trader 5 are the disability for exchange markets hedging and the difficulty of using the advanced trading tools for beginners. In using this broker, you’d better consider these downfalls and decide carefully. As you can see, if you are a beginner, it could be not easy to work with it.

The Things that You Should Do Before Starting Copy Trading

Although this type of trading is beneficial for making money for beginners, you should consider some important things before doing it. The first important thing is to be aware of transactions costs and fees. You should consider the amount of spread and fees of the transactions. The next thing you must be careful in copy type of trading is understanding the concept behind the trading strategies.

Although you have chosen a professional trader to follow, you should pay attention to the trader’s strategies in their transactions. That is because sometimes those strategies won’t be suited to your conditions. So, now you can understand the importance of knowing the trader that you are copying. Knowing the trader not only help you to understand their strategies but also help you to get the rationality of that trader. By considering these three tips, you could have a successful copy type of trading.

The Bottom Line

Copy trading is one of the best ways for beginning your career in trading markets. Simply, copy trading is when you follow the trades of another trader. In this sense, you are the follower, and the trader you are following is called the master. Choosing the right master is the exact thing that guarantees your success in any transactions that you are doing. Thus, in selecting the master, make sure about their proficiency and the adaptability of their trading strategies and goals with yours.

There are several pros and cons in copy type of trading that is knowing them gives you the essential knowledge that you need for deciding whether this type of trading is suitable for you. In finding the best trading system for copy trading, you must not just rely on the popularity they have gained, and you should also study some vital features that they must have for copy trading. You can also ask for the help of the other successful traders to introduce you to the best trading systems for a copy.

Some websites are introducing the best brokers for copy type of trading. Search them and read the other traders’ reviews about each trading platform. Finally, be careful about choosing this type of trading. Know how it works and the things that you must do before starting it. By following all the tips and steps given in this article, you can be hopeful about success in your trading in any field.