People are looking for Forex Trading because entering into its realm is so easy. It seems that you need are a couple of monitors, a mouse, and an internet connection. However, forex markets are full of tricks and risks that if you don’t know them, you will stick in a big trap called loss. Loss in Forex trading is the biggest nightmare for all forex traders. That’s why you will read in this article about the best place to stop loss in forex trading and take target profits.

Further Reading:

Table of Contents

What is a Stop Loss in Forex Trading?

All of the information which is provided in this article is because of the importance of this issue. Almost soon after entering forex trading, you are going to face this question that “Where to place my stop loss and take profit targets?’.

In this regard, you must know the meaning of “Stop Loss” in forex trading to find the right place. From this point, you can get the general way for reaching this goal: Knowledge. Knowledge is always power. Therefore, always seek the basic definition of forex elements and understand them before having conflict with them.

Stop Loss

The term “Stop Loss” in forex trading is an order for opening a trading position in the forex market to get you out of a losing trade at even strong level of the transaction to avoid more loss. So, you can understand that “Stop Loss” in forex trading means stopping any further loss. Note that the majority of the successful forex traders are aware of this critical fact of forex trading, and they know that a wise trader stops loss at any level of the trading.

Profit Targets

Another fundamental concept in forex trading is the profit target. The title is clearly defining the concept by itself. However, suppose we want to define explicitly. In that case, we could mention the definition given by Andrew Lockwood, a successful forex trader and the head mentor of forex trading, “take profit target is closing out a trade and banking a profit.”

Why Use a Stop Loss?

As a trader, you must use a stop loss, and using it is one of the priorities for all traders looking for a bright future in forex trading. The importance of using stop loss is more for the beginners of this popular trading. The primary reason for using stop loss is its essential role in protecting your trading account in front of any unexpected events in forex marketing.

It is clear that all of us are afraid of losing money, and we don’t like to lose the inflation that we have entered into the trading. However, as mentioned before, traders must accept the fact of loss in forex trading. It is better to come to terms with this issue with a straightforward example. Think about a supermarket! Even having business in supermarkets carries out its losses. There are always some products with problems like being out of date and consequently losing the amount of money spent on them.

Now, you are a trader in the extensive market of forex. When are losses unavoidable in the supermarket? Why must it be hard to accept such downfalls in the vast forex market? Be a wise trader and take losses in your job to become able to stop them.

How to Place Stop Losses?

There are several ways for setting stops in forex trading losses. It is necessary for all the traders to know these ways and techniques and to use them at the right time. Some of these ways are explained in this part to help you reduce your tension about losses and take the target profits faster.

Handling your Emotion and Stop Loss

One of the first ways to stop loss in forex trading is by handling your emotional impulse. The fact is that, against all those financial self-help books insisting on putting aside your emotions from trading, trading is a passionate act of doing. You cannot get rid of the impulse of feeling; at least, you cannot do it thoroughly. But, this fact doesn’t mean to be overwhelmed and losing your confidence. Always remember the fact that confidence is one of the best weapons in the battle of trading. So, the problem is that what should we do when we cannot remove our emotions while impulsive actions are significant threats in our business?

The best way to run away from such destructive emotions is to avoid those situations that affect your feelings and make you get carried away. That’s why you must know all the risks that may affect your transaction and all the emotional tricks which make you a loser. Note that impulsive, emotional acts have always been one primary reason for blowing up the trading accounts. So, one of the advantages of using stop loss is to help you handle the extensive emotional impulse.

Always keeps this fact in your mind that losses are integral parts of forex trading. Even with the massive amount of experience, all the traders are in the path of loss. The point is that you must know the places to stop losses; especially, in all those tempting situations that play with man’s greed and making it difficult to get out of such transactions.

Timeframe Charts Analysis

Analyzing is necessary for all the traders. In other words, if you want to be a successful forex trader, you need to know the chart analysis and the different types of forex analysis. Because one of the ways for stopping loss is analyzing charts like timeframe charts; by studying the timeframe chart, you will find the best time for trading and avoid the times called recession times of trading. In this sense, you can use the Stop Loss action at the right time for your transactions.

There are many risk tools and techniques that help you understand where you can make a profit target and stop losses. By using these tools and procedures on the timeframe chart, you know the exact path your trading is going on, and therefore, you can reduce the amount of loss in forex trading.

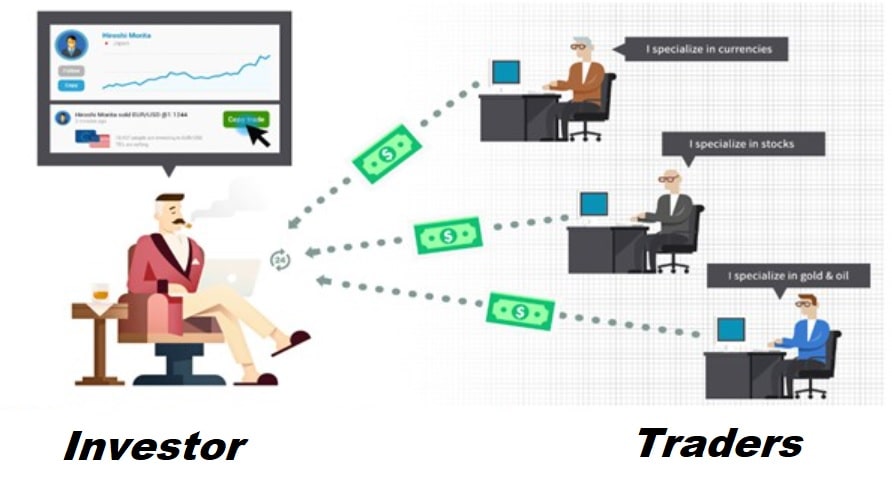

Find a Broker

One of the most important reasons for finding a forex broker is to stop loss in forex trading. A professional forex broker helps you know everything about the trading conditions and find the trading position that brings you more profits. In this sense, you can set the stops in your trading. Forex brokers also help you to know the risk management rules and avoid further loss in your transactions.

Stop Losses for the sake of the profit target

You should set your goals to place the stops on the position that brings you profit; otherwise, stopping losses is for nothing. In the realm of forex trading, you must be the one who kills two birds with one stone. As mentioned above, losses are integral parts of all types of trading, but a trader is successful and uses the losses to achieve more success.

Remember that the forex market is dynamic and livable, constantly updating its assets because of several global events. You must be a Master of Science and art to stop losses in the direction of your profit. And you can be! Because by starting forex trading, you have proved that you are capable of remaining in this market. You need to practice the correct ways to place the stops, record, and review your previous process.

The Bottom Line

Trading foreign exchange is filled with many risks and dangers; that’s why losses are unavoidable in this market. All the successful traders accept this fact and try to take advantage of them by knowing how to stop loss in forex trading to take profit targets. In this regard, they intend to understand the basic concept of stopping loss and taking profit targets.

As a wise trader, you must know why you need to use stops and how to use them. The first thing that you are dealing with is your emotion. You cannot put away your feeling completely, but you can handle them by avoiding any tempting situation. Then you should know how to analyze timeframe charts for stopping the losses. In such cases, a highly qualified forex broker plays an important role. And finally, you need to be industrious in practicing the techniques and analyzing the transactions you have done before.

Resources: